Roth 401k employer match calculator

As of January 2006 there is a new type of 401 k - the Roth 401 k. A Roth 401k is funded with post-tax dollars while a 401k is funded using pretax income.

401k Contribution Calculator Step By Step Guide With Examples

A 401 k can be an effective retirement tool.

. This is the percent of your gross income you put into a after tax retirement account such as a Roth 401k. In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022. Years until you retire.

Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. It provides you with two important advantages.

Roth Retirement Savings Plan Modeler. Roth 401 k vs. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Roth 401 k contributions allow. First all contributions and earnings to your 401 k are tax deferred. As of January 2006 there is a new type of 401 k contribution.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The most common involves matching 050 of every dollar the employee contributes up to a set percentage of employee contributions sometimes called a partial. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

Divide 72000 by 12 to find your monthly gross. The Roth 401 k allows contributions to. 401k Calculator A 401k can be one of your best tools for creating a secure retirement.

Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Calculate your earnings and more.

An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022. The employer match helps you accelerate your retirement contributions. Also the employer match is.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Roth 401k plan withholding. Ad Our Conversion Tool Helps You Determine If Converting To A Roth Is Right For You.

Traditional 401 k Calculator. It provides you with two important advantages. The annual elective deferral limit for a 401k plan in 2022 is 20500.

Forbes Advisors 401k calculator can help you understand how much you can save factoring in your expected age of retirement total contributions employers matching. Many employees are not taking full advantage of their employers matching contributions. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Compare 2022s Best Gold IRAs from Top Providers. A 401 k can be one of your best tools for creating a secure retirement. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

Related Retirement Calculator. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. Your employer match does not count towards your 19500 or 26000 elective deferral limit but it does count towards your 58000 total limit.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. You can also contribute up to 6000 7000 if youre 50 or older to a nondeductible traditional IRA.

A 401 k contribution can be an effective retirement tool. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Not all employers offer Roth 401k retirement vehicles as administrative work for.

While your plan may not have a deferral percentage. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. RMD for Roth IRAs unlike those required for traditional IRAs or 401ks.

Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. A 401 k can be an effective retirement tool. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Traditional 401 k and your Paycheck. Second many employers provide matching.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Reviews Trusted by Over 45000000.

As of January 2006 there is a new type of 401 k -- the Roth 401 k. Some employers even offer a Roth version of the 401k with no income limits. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

-savings-detailed.png)

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

Solo 401k Contribution Calculator Solo 401k

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

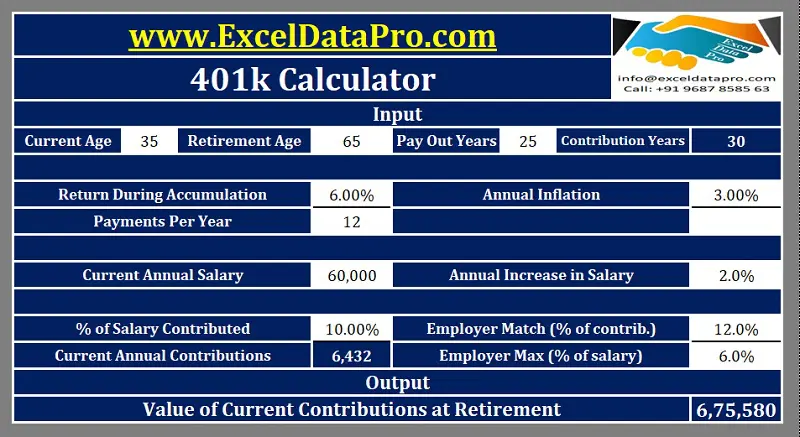

Download 401k Calculator Excel Template Exceldatapro

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

Download 401k Calculator Excel Template Exceldatapro

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Contribution Calculator Shop 56 Off Www Ingeniovirtual Com

Excel 401 K Value Estimation Youtube

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

The Ultimate Roth 401 K Guide District Capital Management

401k Contribution Calculator Step By Step Guide With Examples

Roth 401k Roth Vs Traditional 401k Fidelity

401 K Calculator See What You Ll Have Saved Dqydj

401 K Plan What Is A 401 K And How Does It Work

Retirement Calculator 401k Cheap Sale 52 Off Www Ingeniovirtual Com

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community